Falling for financial scams may signal early Alzheimer’s disease

A groundbreaking study reveals a connection between older adults’ vulnerability to financial scams and brain changes linked to Alzheimer’s disease, offering a potential new tool for early detection.

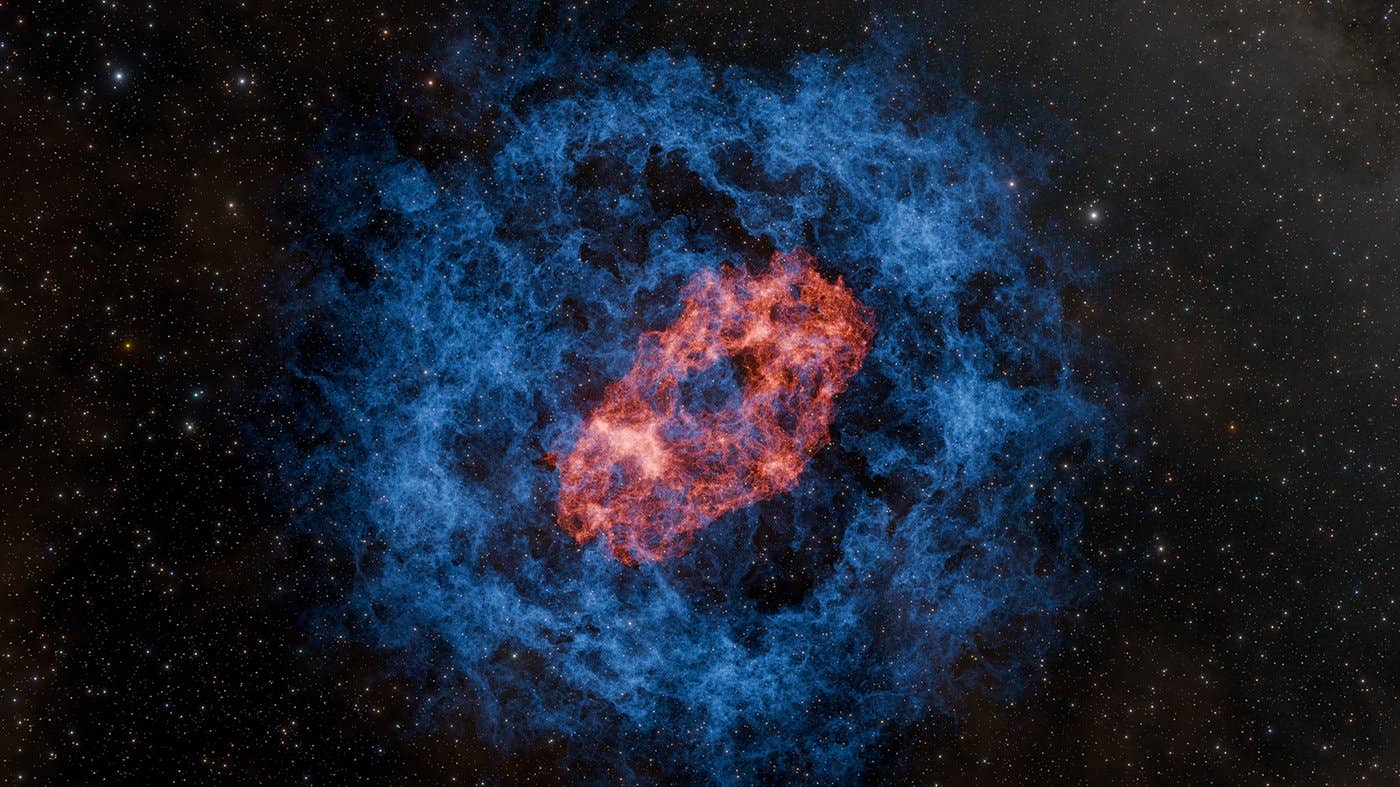

Researchers set out to better understand the connection between early-stage Alzheimer’s and financial vulnerability. (CREDIT: CC BY-SA 3.0)

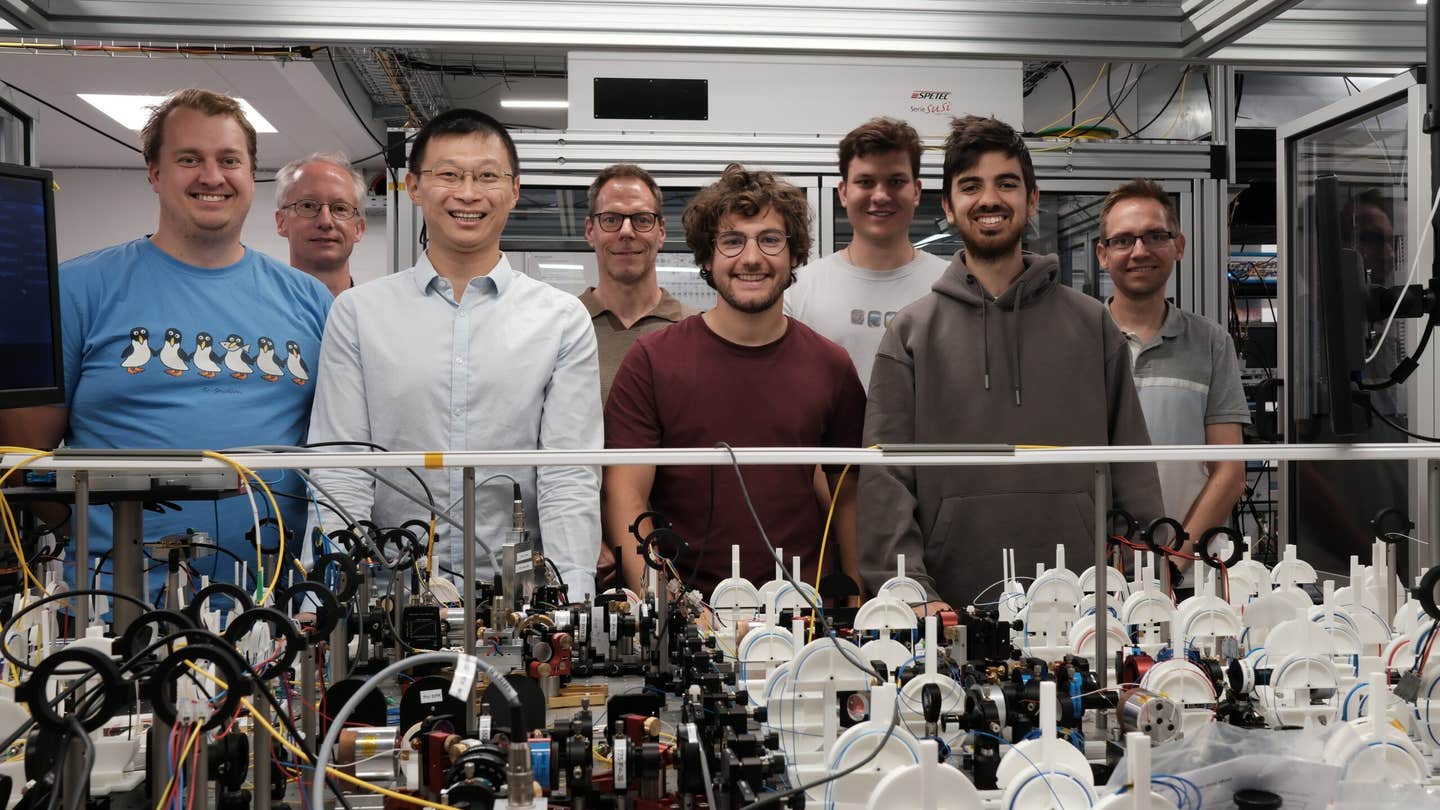

New research shows that older adults vulnerable to financial scams may have brain changes linked to a higher risk of Alzheimer’s disease. The study, conducted by scientists at USC Dornsife College of Letters, Arts, and Sciences, is the first of its kind and focuses on how these cognitive changes may be tied to financial exploitation.

Alzheimer’s disease already affects nearly 7 million Americans, making it the fifth leading cause of death for people aged 65 and older. The financial impact is staggering, with healthcare costs for the disease expected to reach $360 billion this year alone, according to the Alzheimer’s Association.

The research team, led by Duke Han, a professor at USC Dornsife, set out to better understand the connection between early-stage Alzheimer’s and financial vulnerability. Using high-powered MRI scans, they examined the brains of 97 adults over the age of 50, aiming to identify early signs of cognitive decline.

Their focus was on the entorhinal cortex, a region of the brain that acts as a relay between the hippocampus — responsible for learning and memory — and the medial prefrontal cortex, which manages emotion, motivation, and other cognitive functions. This part of the brain is often the first to show signs of Alzheimer’s disease, typically shrinking as the condition progresses.

None of the participants, aged 52 to 83, showed clinical signs of cognitive impairment. However, all underwent MRI scans to measure the thickness of their entorhinal cortex. Alongside the brain imaging, participants were assessed using a Perceived Financial Exploitation Vulnerability Scale (PFVS), a tool designed to measure financial awareness and susceptibility to poor financial decisions, collectively termed as "financial exploitation vulnerability" (FEV).

Related Stories

By analyzing the relationship between FEV and the thickness of the entorhinal cortex, the researchers made a critical finding: participants who were more susceptible to financial scams tended to have a thinner entorhinal cortex. This connection was particularly strong among those aged 70 and older. Previous research has linked FEV to conditions such as mild cognitive impairment and dementia, along with certain molecular changes in the brain associated with Alzheimer’s disease.

Duke Han, who also holds a position at the Keck School of Medicine of USC, believes the findings could support the use of FEV as a new clinical tool for detecting cognitive changes that may signal the early stages of dementia. “Assessing financial vulnerability in older adults could help identify those who are in the early stages of mild cognitive impairment or dementia, including Alzheimer’s disease,” Han explained.

While this study highlights the potential for FEV as a diagnostic tool, Han cautions that financial vulnerability alone is not a definitive sign of Alzheimer’s or other cognitive issues. He suggests that FEV could be part of a broader risk profile rather than a standalone indicator. “Financial vulnerability could become one part of a comprehensive assessment of cognitive risk,” Han added.

There are some important limitations to consider in this study. Most participants were older, white, highly educated women, making it difficult to apply the findings to more diverse populations. Additionally, while a relationship was observed between FEV and the thinning of the entorhinal cortex, the study does not establish a direct cause-and-effect link. The researchers also did not measure Alzheimer’s disease pathology specifically.

These limitations mean that further research is necessary, especially studies involving long-term data and participants from more diverse backgrounds. Han emphasizes that while the initial results are promising, more evidence is needed before FEV can be widely accepted as a reliable cognitive assessment tool. “More research is required to determine how useful financial vulnerability assessment could be in detecting early cognitive changes,” Han stated.

As the population ages and the risk of Alzheimer’s continues to grow, tools like the FEV scale could eventually play an important role in identifying those at risk. With financial scams targeting older adults at higher rates, understanding the connection between financial vulnerability and brain health is crucial. The findings from this study bring new hope to the field, but much work remains to be done before these insights can be translated into clinical practice.

Note: Materials provided above by The Brighter Side of News. Content may be edited for style and length.

Like these kind of feel good stories? Get The Brighter Side of News' newsletter.