Billions of dollars in rare Earth elements found within extinct volcanoes

Iron-rich magma found in extinct volcanoes may be a new key source of rare earth elements, critical for technology and renewable energy solutions.

El Laco, an extinct volcano in Chile. (CREDIT: Fernando Tornos Arroyo)

A new study from The Australian National University (ANU) and the University of the Chinese Academy of Sciences has uncovered a promising source of rare earth elements: iron-rich magma entombed within extinct volcanoes.

These materials could become crucial in the hunt for rare earth metals, which are increasingly in demand due to their importance in technology and renewable energy development.

Rare earth elements, although commonly found, are vital for a range of technologies, including smartphones, flat screen TVs, magnets, electric vehicles, and military systems like missiles. They also play a critical role in renewable energy, particularly in the production of wind turbines. However, extracting these metals is no easy feat, making new sources like iron-rich magma especially valuable.

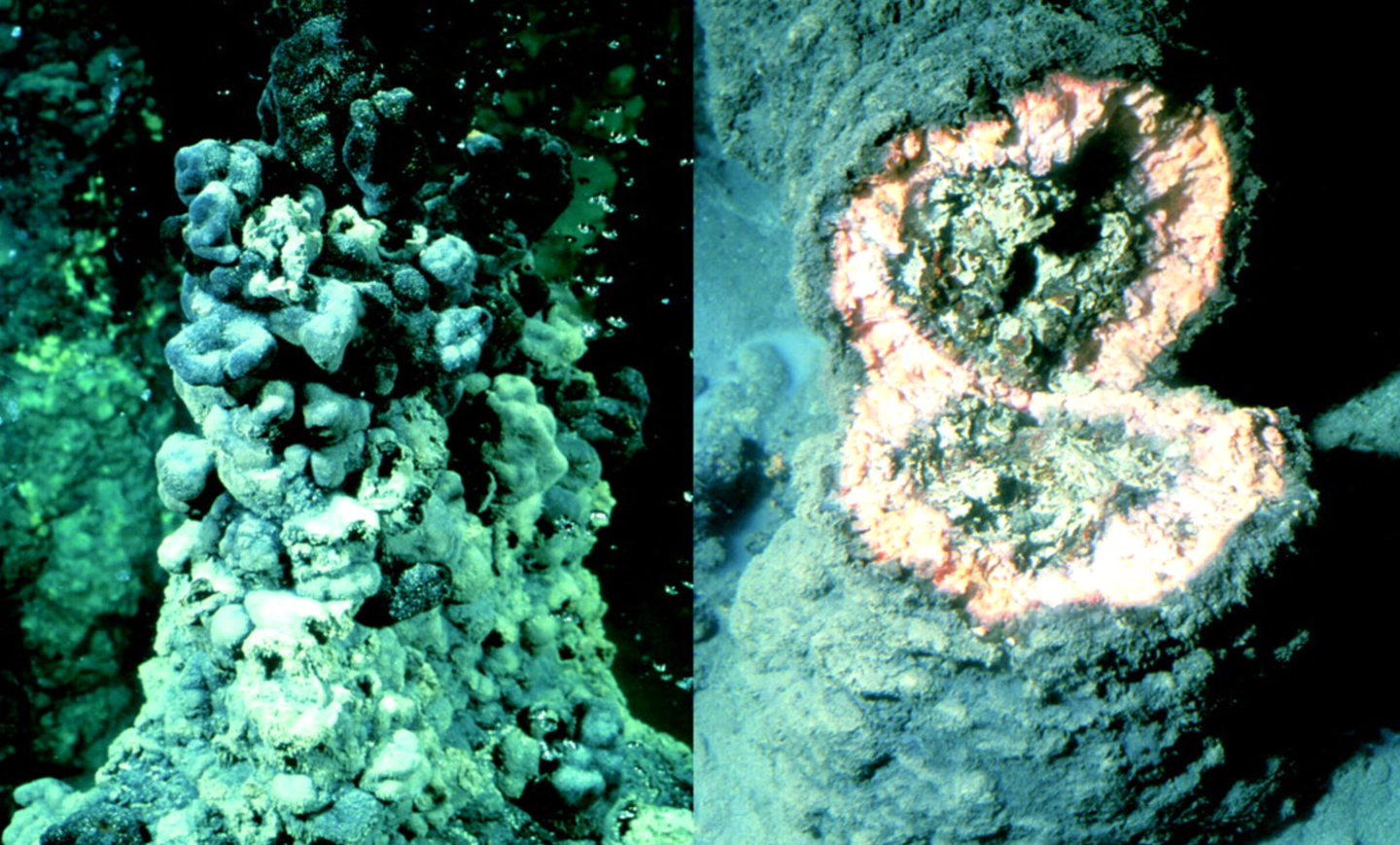

Dr. Michael Anenburg, a researcher at ANU, has found that the iron-rich magma associated with certain extinct volcanoes is far more efficient at concentrating rare earth elements than the magmas typically found in active volcanic eruptions. "We have never seen an iron-rich magma erupt from an active volcano, but we know some extinct volcanoes, which are millions of years old, had this enigmatic type of eruption," Anenburg explains.

His team’s work opens the door to investigating such volcanoes, which could be potential treasure troves of these elements. One such site is El Laco in Chile, a prime example of an extinct volcano that could be studied for rare earth resources.

The research team was able to simulate volcanic eruptions in a lab environment, using rocks that resemble those found in extinct iron-rich volcanoes. By placing these rocks into a pressurized furnace and heating them to extremely high temperatures, they were able to melt the materials and closely study the minerals they contained. This process revealed a significant concentration of rare earth elements in the iron-rich volcanic rocks.

Related Stories

With global demand for rare earth elements expected to rise fivefold by 2030, finding efficient and cost-effective sources is becoming a pressing concern. These elements are in higher demand now due to the increasing investment in renewable energy technologies by countries worldwide.

While rare earth elements are relatively abundant, comparable to metals like lead and copper, extracting them is notoriously difficult. The minerals in which they are embedded are tough to break down, requiring sophisticated and expensive processes to access the valuable metals within.

China is currently the largest holder of rare earth element deposits, but other countries also possess significant reserves. For instance, Europe’s largest rare earth deposit is located in Sweden, while Australia boasts a world-class deposit at Mount Weld, with other notable sites near Dubbo and Alice Springs. Given this wealth of resources, Australia has a clear opportunity to expand its role in the clean energy market by tapping into its rare earth deposits.

The potential of iron-rich extinct volcanoes to become a new source of rare earth elements could offer a more efficient way of meeting the soaring demand. If explored further, these sites might be developed into reliable and cost-effective sources of metals that are critical for the transition to greener technologies.

According to Dr. Anenburg, this research could pave the way for Australia to strengthen its position as a leader in supplying clean energy materials, a growing necessity in the global shift toward sustainable energy solutions.

The findings from this study, published in Geochemical Perspectives Letters, provide important insights for scientists and policymakers as they work to secure the materials necessary for the ongoing development of renewable energy technologies. The research, led by Shengchao Yan from the University of the Chinese Academy of Sciences, highlights the importance of interdisciplinary efforts in addressing the challenges posed by modern technology demands.

Largest sources of rare Earth elements on Earth

The largest sources of rare earth elements (REEs) are mainly found in a few key regions across the globe, as these elements are not evenly distributed in Earth's crust. The major sources of rare earth elements are:

1. China

- Production Dominance: China is the world's largest producer and exporter of rare earth elements, accounting for about 60-70% of global production.

- Annual Production: ~210,000 metric tons (2023 estimate)

- Value of Production: China dominates global rare earth production, contributing approximately $5.7 to $6.5 billion annually.

- Key Deposits: The Bayan Obo mine in Inner Mongolia is the largest source of rare earth elements in the world, producing elements like neodymium, dysprosium, and praseodymium.

- Reserves: China holds around 37% of global rare earth reserves.

2. United States

- Mountain Pass Mine: Located in California, this mine is one of the largest rare earth deposits in North America. It was once a major global producer but now plays a smaller role due to competition from China.

- Annual Production: ~43,000 metric tons (Mountain Pass Mine)

- Value of Production: Roughly $1.2 to $1.4 billion annually.

- Reserves: The U.S. has about 1.5 million metric tons of rare earth reserves.

3. Australia

- Mount Weld: One of the richest rare earth mines, located in Western Australia. The mine is owned by Lynas Corporation, a significant non-Chinese supplier of rare earths.

- Annual Production: ~22,000 metric tons (Lynas Corporation, Mount Weld Mine)

- Value of Production: Approximately $600 to $700 million annually.

- Global Role: Australia has emerged as a leading source of rare earths outside of China, producing a significant share of heavy rare earth elements (HREEs).

4. Myanmar

- Resource Base: Myanmar has rapidly become a key supplier of rare earth elements in recent years. However, geopolitical factors and environmental concerns limit its full potential.

- Annual Production: ~30,000 metric tons (estimates fluctuate due to inconsistent reporting)

- Value of Production: Estimated at $800 million to $1 billion annually.

- Supplies to China: Much of Myanmar's rare earth output is exported to China for processing.

5. India

- Monazite Deposits: India has substantial monazite reserves, particularly along its southern coastlines. These deposits are rich in thorium and rare earth elements, including cerium, lanthanum, and neodymium.

- Annual Production: ~3,000 metric tons

- Value of Production: Estimated at $50 to $100 million annually.

- Underutilized Resources: Despite significant potential, India currently produces a smaller share of global rare earths due to regulatory and infrastructural limitations.

6. Brazil

- Significant Reserves: Brazil holds some of the largest rare earth reserves in the Western Hemisphere. Its deposits include monazite sands that are high in rare earth content.

- Annual Production: ~1,000 metric tons

- Value of Production: Estimated at $20 to $40 million annually.

7. Vietnam

- Untapped Potential: Vietnam has considerable rare earth reserves, with its deposits still largely undeveloped. There is growing interest in expanding exploration and production in the region.

- Annual Production: ~3,000 metric tons (estimates)

- Value of Production: Estimated at $50 to $100 million annually.

8. Greenland

- Emerging Source: Greenland has significant untapped rare earth resources, particularly in the Kvanefjeld deposit, which contains both rare earths and uranium. However, environmental concerns have delayed large-scale mining efforts.

- Annual Production: Currently minimal but expected to be significant in the coming years if full-scale mining begins.

- Value of Production: $0 million at present; potential future annual value is estimated to be in the billions depending on the scale of operations and global market prices, especially considering Greenland's deposits include valuable heavy REEs like dysprosium and terbium.

Global Market Value (2023 estimate)

- The total global rare earth market is valued at around $13 to $15 billion annually, and China's control of processing adds additional value to its raw material exports. As global demand for rare earths increases, particularly for technologies like electric vehicles, wind turbines, and electronics, the market value is expected to continue rising.

- These values are estimates and can fluctuate based on factors like commodity price shifts, geopolitical events, supply chain disruptions, and technological advancements.

While China currently dominates both the production and reserves of rare earth elements, other countries such as the U.S., Australia, and emerging nations like Myanmar and Greenland are key players in the global market. Expansion of rare earth mining and processing outside of China is considered a strategic priority for many nations, given the importance of these elements in advanced technologies such as electronics, renewable energy, and defense systems.

Note: Materials provided above by The Brighter Side of News. Content may be edited for style and length.

Like these kind of feel good stories? Get The Brighter Side of News' newsletter.